Business Owners Policy (BOP)

If you own and/or run a smaller business, your insurance needs are handled by a business owners policy (BOP). A BOP is a single form that offers both property and liability protection. Businesses eligible for BOP coverage are – retailers, wholesalers, contractors, dry cleaners, restaurants, offices, and convenience stores. This is as long as they do not exceed the square foot or annual sales limits established for the program. Cooking operations, due to the higher fire and other accident exposures, have significantly more restrictive guidelines.

Property Coverage

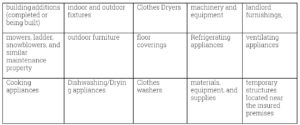

BOPs protect buildings, including the following:

One item of importance, the BOP does NOT provide coverage for loss of use of the damaged or destroyed property. Neither for loss created by an actual or perceived loss in value of goods after a loss takes place.

The policy’s protection is for business personal property (such as office equipment, copiers, desks, etc.). Protection applies whether the property is located inside or immediately outside the covered buildings. It also includes property you own, lease, or control (i.e., borrow or control) as long as the property is used by the business.

Liability Coverage

A BOP’s liability coverage provides comprehensive protection for claims or suits made by other parties. Specifically, it covers losses involving injury to other persons or damage to property that belongs to others. It also provides limited protection against personal injury (slander or libel), advertising injury, and losses involving an operation’s products or services.

Naturally, certain situations are not covered by a BOP. For instance, there is no coverage for losses involving most vehicles, money, and securities; illegal property (contraband), land, water, growing crops or lawns; or watercraft.

Enhancing Coverage

Supplement a BOP to provide additional protection. Property coverage options include adding insurance for accounts receivable, valuable papers and records, earthquake, spoilage, etc. Liability coverage can be expanded to handle additional business interests, limited vehicle liability, losses related to personnel situations, liquor liability, and injuries to leased employees.

A BOP may be the answer to your company’s coverage needs, and it may be worthwhile to get more information on the BOP from the nearest insurance professional.

Optional Coverages for Businessowners Policy:

Outdoor Signs

Payment is available for direct physical loss or damage to outdoor signs at the described premises. However, it must be in the named insured’s care, custody, or control.

Money and Securities

Coverage applies to loss of only the named insured’s money and securities used in its business. This is in reference to while that property is at banks or savings institutions, inside the named insured’s living quarters, inside the living quarters of a partner or employee, at the described premises, or while in transit between the places referenced.

Employee Dishonesty

A BOP policy pays for direct loss of business personal property, and money and securities, due to dishonest acts committed by its employees.

Equipment Breakdown Protection Coverage

Coverage is available for loss or damage directly caused by or that results from electrical failure or mechanical breakdown to covered property. Covered property is electrical, mechanical, or pressure machinery and equipment.

Liability Coverage

A BOP’s liability coverage provides comprehensive protection for claims or suits made by other parties. Specifically, it covers losses involving injury to other persons or damage to property that belongs to others. It also provides limited protection against personal injury (slander or libel), advertising injury, and losses involving an operation’s products or services.

Naturally, certain situations are not covered by a BOP. For instance, there is no coverage for losses involving most vehicles, money, and securities; illegal property (contraband), land, water, growing crops or lawns; or watercraft.

Enhancing Coverage

Provide additional protection with a BOP. Property coverage options include adding insurance for accounts receivable, valuable papers and records, earthquake, spoilage, etc. Liability coverage can be expanded to handle additional business interests, limited vehicle liability, losses related to personnel situations, liquor liability, and injuries to leased employees.

Contact Us

A BOP may be the answer to your company’s coverage needs, and it may be worthwhile to get more information on the BOP from your Hertvik Insurance Group professional.