Do I Need Insurance for My Trampoline?

Your kids are bouncing with joy. The backyard trampoline you just installed is already the hit of the neighborhood—until someone takes a bad fall. Suddenly, your homeowner’s insurance comes to mind, and the questions start flying faster than a somersault. Does my policy cover this? Am I liable if a neighbor’s child gets hurt? Could my premium go up—or worse, could I be denied coverage altogether?

If you own a trampoline—or are thinking about buying one—it’s time to get serious about how it affects your insurance. The truth is, trampolines bring big fun, but also big risk. Here’s what you need to know.

Trampolines Are Often Considered an “Attractive Nuisance”

In the insurance world, an attractive nuisance is something on your property that’s likely to attract children—and could potentially harm them. Think swimming pools, treehouses, and yes, trampolines.

That means you could be held liable even if someone uses your trampoline without permission.

Example:

Let’s say a neighborhood kid sneaks into your yard while you’re not home and gets injured on your trampoline. You could still be held responsible for their medical bills. That’s why some insurers either refuse to cover homes with trampolines or require certain safety measures (like a locked gate or safety netting) to maintain coverage.

Your Homeowners’ Insurance May Exclude Trampoline Injuries

Not all homeowners’ policies are created equal. Some exclude trampolines outright, while others may offer coverage with strict guidelines. And even if your policy allows trampolines, it might only cover liability—not property damage or medical payments.

Example:

A guest’s child breaks an arm while using your trampoline during a birthday party. If your policy excludes trampoline-related injuries, you may be stuck paying the hospital bill out of pocket. Even if it’s covered, your insurer could raise your premium—or choose not to renew your policy down the line.

To avoid surprises, it’s important to review your policy and ask the right questions.

Insurers May Require Specific Safety Measures to Offer or Maintain Coverage

Insurance companies want to minimize risk—so if they allow trampoline coverage, they’ll often require that homeowners take extra precautions.

Example:

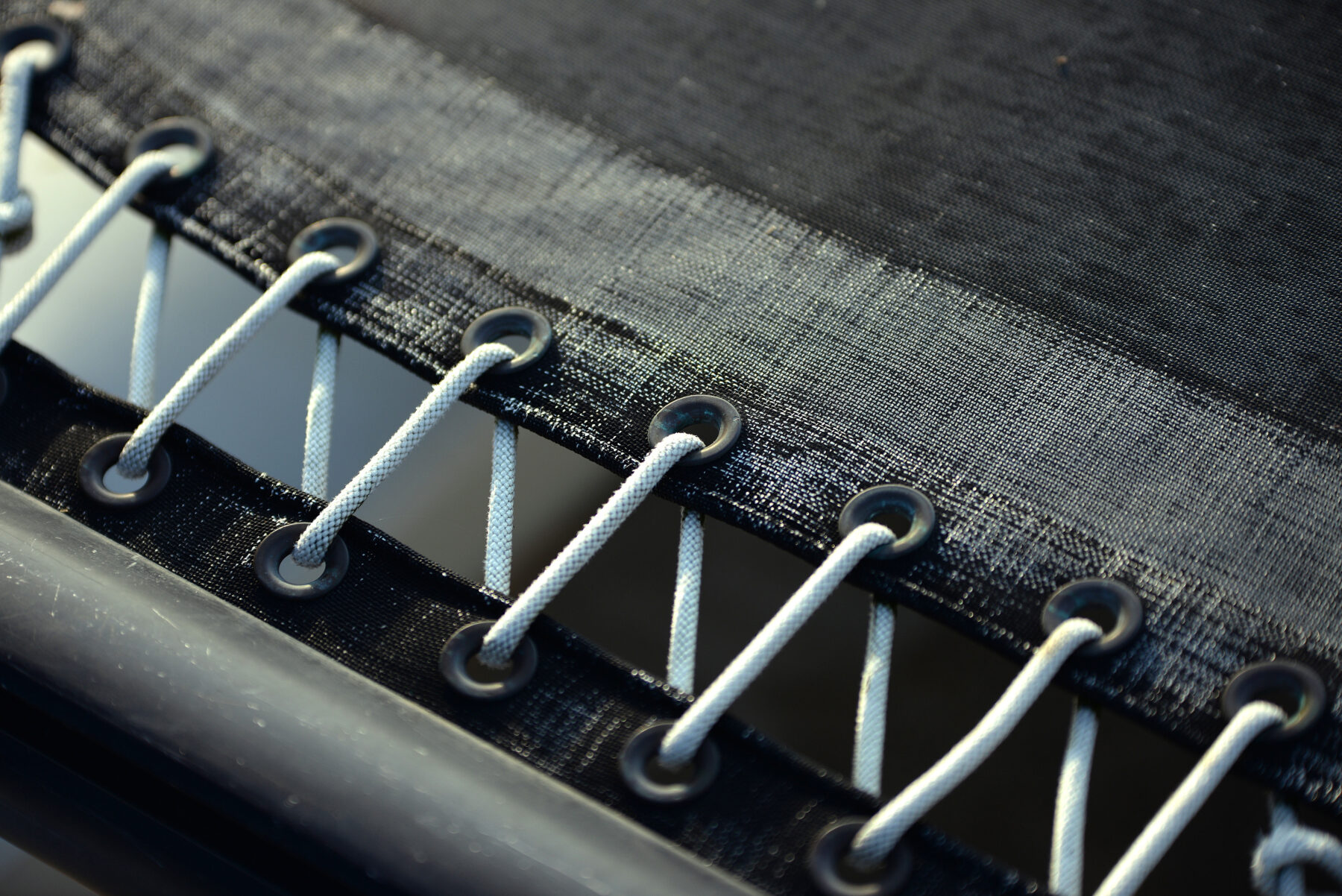

Some carriers will only insure homes with trampolines if you install safety nets, anchor the trampoline to the ground, place it on a level surface, and enclose your yard with a locked fence. Others may require you to exclude trampoline use entirely from your policy to avoid coverage complications.

The takeaway? Being proactive about safety isn’t just smart—it could be the difference between being insured or denied coverage altogether.

Final Thoughts: Bounce Safely, Insure Smart

Whether you already own a trampoline or are considering adding one to your backyard fun zone, don’t make the mistake of assuming your insurance will automatically cover it.

Trampolines can change your liability exposure in a big way—and every insurance policy is different. The best way to protect your family, your guests, and your wallet is to speak with a knowledgeable insurance advisor who understands the ins and outs of trampoline coverage.

Contact Hertvik Insurance Group today to review your current homeowners policy or to explore your options before making a trampoline purchase. We’ll help you bounce with peace of mind—knowing you’re covered where it counts.