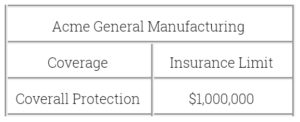

Policy Insurance Limits

If you examine the insurance policy covering your business, you’ll see an policy insurance limit. For instance:

According to the above, it may appear that you have a million dollars in coverage. But what does that mean? Well, traditionally, such an insurance limit provides up to one million dollars of coverage for each eligible loss that takes place during the applicable (annual) policy period. This is often called an “occurrence” limit because the entire amount is available to respond to each eligible incident that occurs during the policy period. An “aggregate” limit provides another type of protection, a maximum amount that applies over a given policy period.

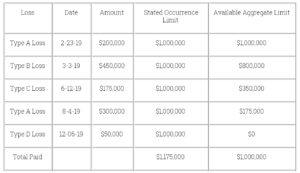

The Acme policy above has a Jan. 1, 2020, to Dec. 31, 2021 policy period. During the policy period, Acme is sued five times.

Under the “Occurrence” limit, the total policy amount was available for each loss. Under the “aggregate” limit, each loss reduced the available limit until coverage was exhausted. In this situation, Acme would have had to handle $175,000 on its own. Please see part two of this discussion on how an aggregate limit affects your protection.

In this second part, we continue with an example of how insurance limits would apply on an aggregate basis. An aggregate limit is the most an insurer will pay during a policy term. Please be sure that you have read Part 1 of this discussion.

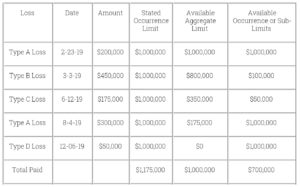

Aggregate limits are used by various insurers and/or for various instances where the company wishes to be more certain about its total possible financial exposure. Some insurers and some types of policies may use sub-limits as a method to control the amount they pay for losses. A sub-limit is a coverage amount that applies to certain types of losses or losses involving certain types of property. Sub-limits are used with either “occurrence” or “aggregate” limit policies. To keep things less confusing, let’s use the same Acme policy situation and adding an Occurrence policy with sub-limits. In this instance, the policy provides the following:

$100,000 Sub limit for Type B Losses

$50,000 Sub limit for Type C Losses

Even though it has an “occurrence” limit, the sub-limits have had a drastic impact. In this instance, Acme is left to handle $475,000 in losses unpaid by the policy.

Because of the existence and the impact of different types of limits, you should be certain of exactly what your policies provide. A Hertvik Insurance Group professional is just the person to contact to discuss this fundamental issue.