Home Based Business Auto

Do you operate a business from your home? If so, you have likely arranged for the proper coverage to protect your property, such as business equipment and furnishings that you use with that business. You, hopefully, have also taken care of your premises liability. In other words, this is protection for injury to business visitors or property damage that is directly related to your in-home operations. However, what about losses caused by vehicles? Are any cars, vans, or trucks used in your business? If so, do you have the right protection?

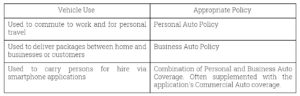

When is it necessary to switch from a personal to a business auto policy? It helps to consider how your vehicle is used. If there’s no difference between how you use your car personally, then you may be safe relying on the protection of your personal auto policy. But, rather than guess, you should take a close look at precisely how you use any vehicle. Both personal and business insurance policies define the type of vehicles that are eligible for coverage. One defining item is the weight of a vehicle. In many standard, personal policies, heavier vehicles (those weighing 10,000 pounds or more) are ineligible for personal policy coverage. Regardless of the vehicle weight, the primary consideration is the vehicle’s use.

Concerning a home business, some key questions to determine which kind of policy is needed might include the following:

- Does anyone use a car regularly to go to homes or businesses of clients?

- Does anyone travel to perform demonstrations of a product or service?

- Does any vehicle have signage on its exterior that displays the company’s name and contact or other information?

- Is any vehicle owned in the name of a business entity?

Besides the above, there are other important considerations. If you borrow or rent a vehicle to move business equipment, you won’t have coverage under a personal auto policy. Also, business use of non-owned pickup trucks, vans, or similar vehicles (SUVs, hybrids, etc.) is excluded. Home-based business owners also need to be aware that a problem arises when renting a vehicle while on a business trip. A personal auto policy may only provide very limited coverage and only under narrow circumstances.

If you have any doubt about your coverage, you should seek the advice of a Hertvik Insurance Group professional to examine your business and vehicle use.