Mobile Equipment

You might think that an insurance policy that is designed to protect autos and trucks that are used by a business, would cover any type of vehicle. That is a dangerous assumption, at least with regards to providing full, complete protection. There are instances when coverage for damage to certain types of vehicles and the legal responsibility for their use may have to be covered by two different policies. Mobile equipment falls into that nether region of insurance coverage.

The simple distinction between regular commercial vehicles and mobile equipment is that, while vehicles have the primary purpose of transportation of persons or property, the primary purpose is to perform the special function of the particular machinery. With the latter property, its mobility acts merely to get the equipment to a site in order to complete a given job.

Classification

Because of this difference, mobile equipment qualifies for coverage under:

- A commercial automobile policy when the loss involves the operation of the property as a vehicle, particularly traveling to and from job sites, while being loaded, entering in and out of it, and in similar circumstances.

- A commercial property or commercial general liability policy when the loss involves the operation of the property as equipment. Generally, the equipment is parked and anchored during such use.

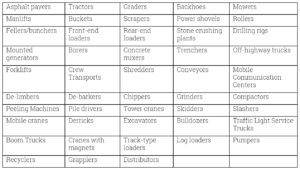

Many types of mobile equipment are used in construction, mining, farming, commercial cleaning, sign installation, roadwork, and other heavy-duty work situations. The variety of equipment, consisting of both self-propelled units and trailers, is endless.

Examples of Mobile Equipment

Though not an inclusive list, examples include:

When you have to protect a vehicle that also functions as equipment, be sure to discuss your situation and coverage with a Hertvik Insurance Group professional.